HOW A SCORE IS CALCULATED

A credit score is a number that ranks a consumer’s credit risk based on a statistical evaluation of information in the consumer’s credit file, information that has been proven to predict loan performance. In layman’s terms, a credit score is simply a number that represents the risk that you will default on a loan, using your prior payment history as a benchmark.

Scoring Models and Goals

Each mathematical algorithm used to calculate credit scores is unique, so we work with our clients to identify their personal goals and work to restore their individual credit to best fit their upcoming loan. For example, if your goal is to purchase a new home, then your credit restoration plan should focus on improving your FICO score, the score used by mortgage lenders. Read below to find out more about the different factors that can affect your credit score.

FICO

Though it is only one model, the FICO score is complex – too complex to describe in detail here. The overview presented here provides an introduction to the factors that contribute to the FICO score. To learn more about the FICO score and other scoring models, please contact us, and we will contact you directly at your convenience.

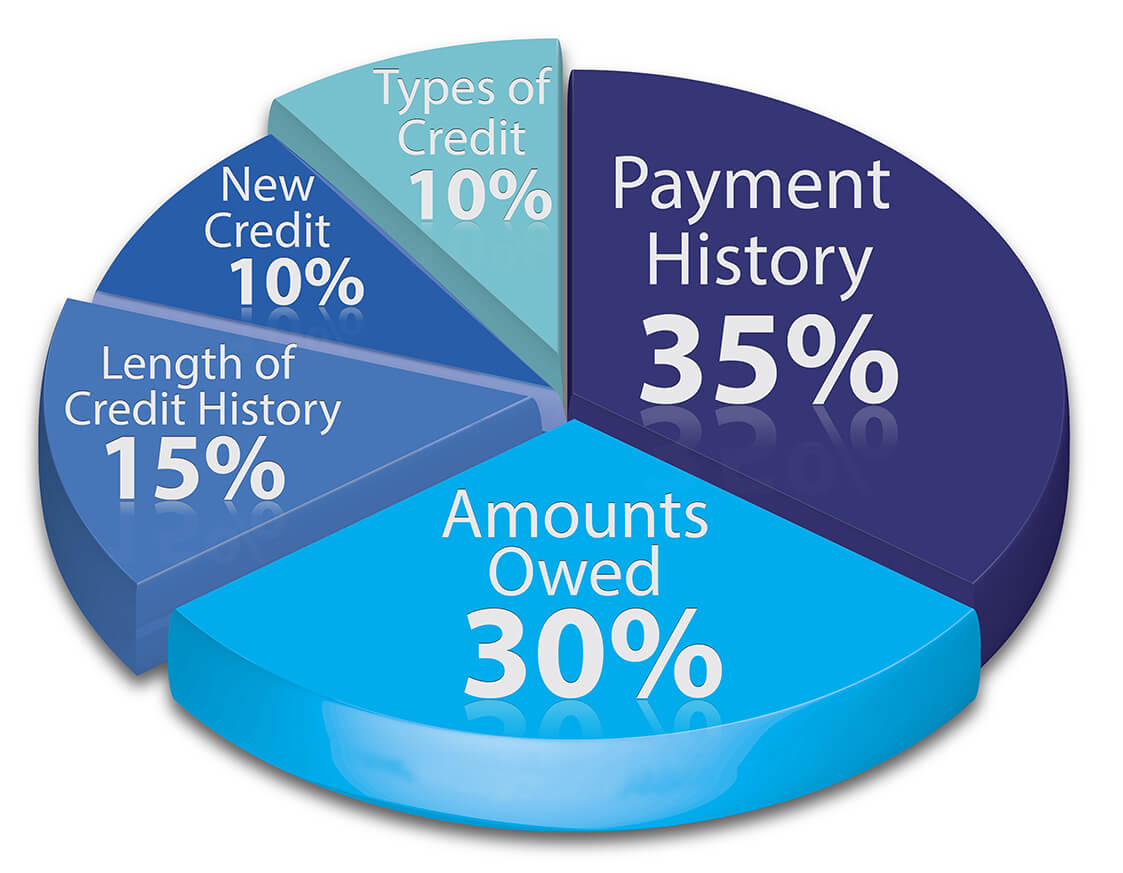

FICO WEIGHTS

The FICO score is based on five different weighted factors that can be viewed within the pie chart:

- Payment History: The record of your on-time and late payments

- Available Credit: Your credit limit minus the amount you owe for each account

- Length of History: The time elapsed since each account was opened

- Number of Inquiries: Records of inquiries logged when you apply for credit

- Type of Credit: Mortgages, installment loans, revolving accounts, etc.

AGE OF INFORMATION

In addition to factor weights, the FICO model applies different weights to information based on how old it is. The newer the information is, the more it affects the score.

REVOLVING CREDIT

It is imperative that a balance is carried on your revolving accounts. Keeping these balances below 30% is the ideal to maximize this portion of your score.

NON FACTORS

The FICO model does not incorporate any of the following factors: age, education, income, race, marital status, length of residence, gender, or disability.

Improve Your FICO Score

With all the different kinds of information that credit scoring models incorporate, numerous tactics for improving scores are available. However, any action to improve a score must be taken judiciously. Be aware that some actions aimed at improving your score may actually make it worse. Contact us, and we can help you determine which steps will help your credit the most.